Oil does its usual 10% swing in a day, nat gas spikes on weather bullshit, gold reacts to every Fed whisper. Retail wants to hedge or play it, but TradFi gates it hard: markets shut weekends/holidays, KYC onboarding takes days, custodians lock collateral and charge you for the privilege, fees eat half your edge.

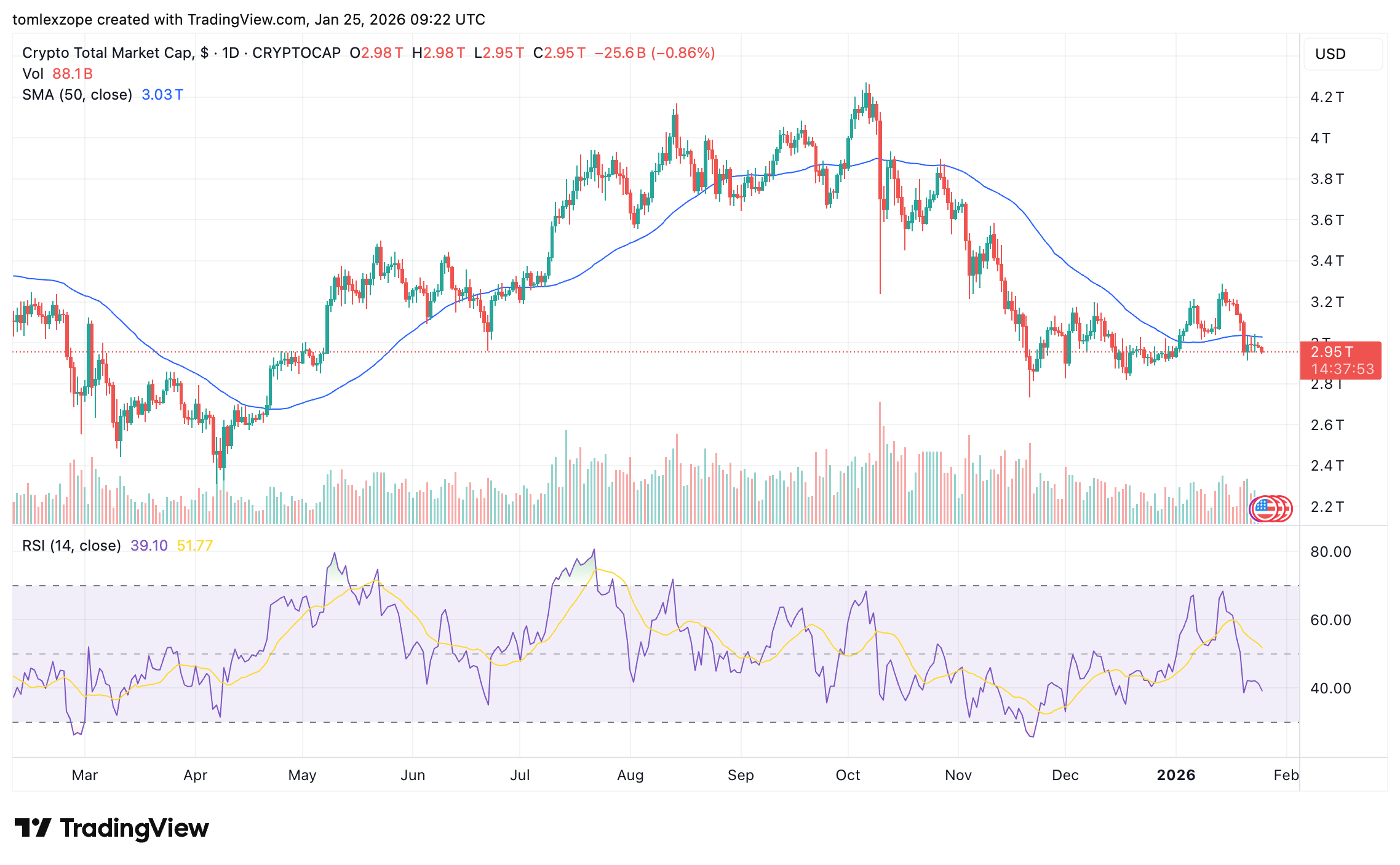

Crypto has perps for everything under the sun (memes, alts, even indices), but actual commodity derivatives on-chain? Crickets. Imagine posting BTC or stablecoin margin, trading 24/7 perps on crude/metals/energy, cross-margining positions, atomic clears, no middleman skimming.

The macro plays are right there ($140T market begging for disruption) but we're still stuck watching from the sidelines or getting rekt in spot. Liquidity would come if the pipes existed, oracles improved, etc.

Is this just too hard (reg/oracle/liquidity doom loop), or the next obvious DeFi unlock after RWAs like bonds? Would you actually use BTC-backed commodity perps if they were live and liquid, or nah—stick to crypto-native volatility?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments